Understanding Credit Facility Covenants and How BankStride Software Assists

Credit facility covenants are essential components of loan agreements that stipulate conditions borrowers must adhere to in order to maintain their credit lines. Monitoring these covenants is crucial for compliance, financial health, and maintaining good relationships with lenders. This article explores the importance of credit facility covenants and how BankStride software enhances covenant monitoring and management.

What are Credit Facility Covenants?

Credit facility covenants are essential components of loan agreements that stipulate conditions borrowers must adhere to in order to maintain their credit lines. Monitoring these covenants is crucial for compliance, financial health, and maintaining good relationships with lenders. This article explores the importance of credit facility covenants and how BankStride software enhances covenant monitoring and management.

1. Financial Covenants: These are specific financial metrics that the borrower must maintain throughout the term of the loan. Common financial covenants include:

2. Non-Financial Covenants: These covenants impose operational and administrative requirements, such as:

-

Debt-to-Equity Ratio: Limits the amount of debt relative to shareholders' equity.

-

Current Ratio: Ensures the borrower has enough short-term assets to cover short-term liabilities.

-

Interest Coverage Ratio: Measures the borrower’s ability to meet interest payments with earnings before interest and taxes (EBIT).

-

Leverage Ratio: Controls the total debt relative to total assets.

-

EBITDA-to-Debt Ratio: Ensures the borrower generates sufficient earnings before interest, taxes, depreciation, and amortization (EBITDA) relative to their debt.

-

Reporting Requirements: Mandate regular submission of financial statements and compliance reports.

-

Restrictions on Additional Debt: Limits on incurring additional debt without lender approval.

-

Restrictions on Dividends: Limits on the amount of dividends that can be paid to shareholders.

-

Asset Disposition Restrictions: Prevent significant asset sales or disposals without lender consent.

The Importance of Monitoring Credit Facility Covenants

Monitoring credit facility covenants is vital for several reasons:

-

Compliance: Ensures the borrower adheres to the terms of the loan agreement, avoiding penalties or defaults.

-

Risk Management: Early identification of potential covenant breaches allows for proactive measures to mitigate risks.

-

Lender Relations: Maintaining covenant compliance fosters trust and credibility with lenders, which is essential for future financing.

-

Financial Stability: Adhering to covenants promotes disciplined financial management and long-term stability.

How BankStride Software Enhances

Covenant Monitoring

BankStride software offers a comprehensive solution for monitoring and managing credit facility covenants, providing several key features that streamline and automate the process:

Automated Data Extraction and Integration

BankStride integrates with existing financial systems, enabling seamless extraction of financial data from statements and reports. This ensures accurate and current information for covenant calculations.

Real-Time Monitoring and Alerts

The software provides real-time monitoring of financial metrics against covenant thresholds. It generates alerts and notifications when covenants are at risk of being breached, allowing for timely corrective actions.

Customizable Dashboards and Reporting

BankStride offers customizable dashboards that give a clear overview of covenant compliance status. Detailed reports can be generated to meet internal and external reporting requirements, enhancing transparency and accountability.

Benefits of Using BankStride for

Covenant Monitoring

Risk Mitigation: By providing real-time alerts and comprehensive monitoring, BankStride helps mitigate the risk of covenant breaches and financial penalties.

Accuracy: Integration with financial systems ensures that the data used for covenant calculations is accurate and up-to-date, reducing the risk of errors.

Efficiency: The automation of data extraction, monitoring, and reporting streamlines the covenant management process, saving time and resources.

Enhanced Compliance: BankStride ensures that all covenant requirements are met, maintaining compliance with loan agreements and fostering strong lender relationships.

Covenant Tracking & Monitoring are important part of managing borrowers financial and reporting documents for loan monitoring. Almost 70% of banks still rely on some combination of spreadsheets, core ticklers, or other manual processes.

BankStride is a digital banking platform you've been waiting for. BankStride makes it easy for banks to automate loan documents, exceptions tracking, loan reporting and covenant monitoring. No more managing checklists, searching for files in emails, or waiting on updates from other parties. Just create your requests and let BankStride do the work for you.

Many Banks and lending companies depend on non-public client information to provide their

services. Examples include:

-

Automate Document Gathering

-

Checklist For Loan Reporting Requirements

-

Frictionless Customer Experience To Send Documents

-

Create Credit Exceptions & Tickler Tracking

-

Automated Loan Monitoring and Loan Compliance

-

Loan Reporting, Risk & Financial Reporting

Without a dedicated tool, professionals would have to manually manage checklists and calendar

events to keep track of all required information. BankStride automates this work while improving

security and reporting.

Why BankStride platform

BankStride is a web-based software solution for commercial banks and credit unions that works with customers to manage loan agreements and eliminate credit exceptions. FileStride improves credit exception management by reaching beyond the walls of the bank to work directly with customers.

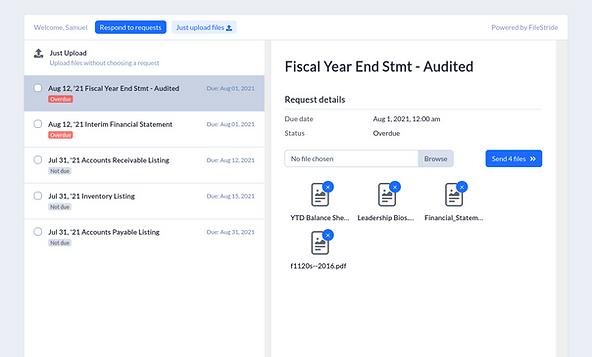

Customers respond to information requests much like paying an online invoice – they clearly see what’s required of them and they act. Customers can respond using a login-less portal or by email – no account or password required.

With BankStride, banking teams can schedule recurring requests for documents like financial statements and tax returns, compare actual and threshold covenant values (e.g. minimum DSCR), and send compliance certificates for signature via DocuSign.

BankStride is like autopay for customer information.

Streamlining Loan Underwriting, Loan Monitoring, Covenants, and Financial Reporting

Automate Bank customer information requests for covenant monitoring , loan reporting, financial reporting and exception handling.

FiStride allows you and your customers to exchange information with zero friction so that you can reduce credit exceptions and recover valuable time.

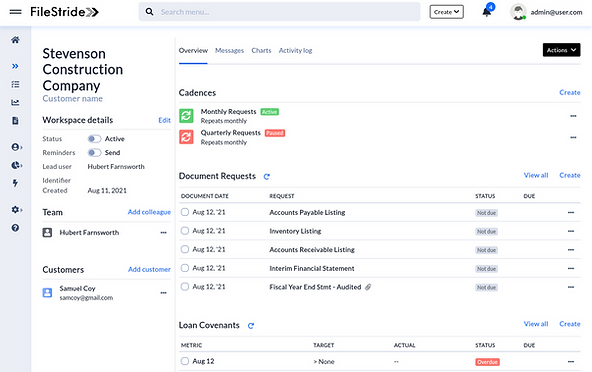

The Workspace view in FileStride gives you a holistic overview of what you have, what you need, and where your customer stands.

Get a quick pulse check on where your projects stand with the Dashboard view in FileStride.

The Workspace view in FileStride gives you a holistic overview of what you have, what you need, and where your customer stands.

Executive Summary

Credit facility covenants are crucial for maintaining the terms of financial agreements and ensuring the financial health of borrowers. Effective monitoring of these covenants is essential for compliance, risk management, and maintaining positive lender relationships. BankStride software offers a robust solution for automating and enhancing the monitoring of credit facility covenants, providing features that improve accuracy, efficiency, and overall financial management. By leveraging BankStride, companies can effectively manage their financial obligations, mitigate risks, and support sustainable growth.

BankStride is powerful for bankers

Flexible information management

BankStride supports one-off and recurring information requests with flexible storage layer configuration options.

Healthcare & Life Sciences

Bank leadership can drill down to identify pockets of risk and underperformance, ensuring every team member knows where to focus.

Loan Monitoring

Track financial reporting, covenants, and certificates, and issue compliance certificates for signature via DocuSign.

A Clear Banker's View

See your portal in action.

Easy for bank customers

No usernames and no passwords

Customers receive tokenized links for portal access, and bankers can request information from anyone with an email address.

Upload or email

Easy-to-use customer portals show exactly what is needed, while email-based file ingestion lets customers respond by emailing files.

Timely alerts

Reminders and alerts are aggregated to prevent information overload, can be toggled per user, and feature customizable schedules.

A Clear Customer's View

See your portal in action.

How does our bank customer use BankStride

For example, BankStride has proven effective in managing revolving lines of credit. BankStride automatically requests and reminds customers to submit monthly AR and AP listings, inventory analyses, and borrowing base certificates each month.

BankStride reminds the banking team to test various financial ratios. The results of the customer’s actions and the ratio testing all roll up to per-banker and per-office reports that can be run on-demand in seconds.

Our bank customer uses BankStride to schedule and automate the activities required to monitor loan agreements.

How does this help banks

Banks that pursue superb loan agreement management are faced with handling complex recurring tasks using the basic tools of email, spreadsheets, and calendar ticklers. Banks that let this work fall behind risk delaying their awareness of problematic loans or operating practices, jeopardizing capital and reputation.

A borrower’s risk profile can change significantly over the years that follow a lending event. Managing loan agreement adherence through reporting and internal monitoring is an ongoing and tedious battle for banks.

With BankStride, banks gain high-resolution loan agreement monitoring that saves time and delights customers.

Know what you have, know what you need.

BANKERS STREAMLINE LOAN REPORTING DOCUMENTS

Why BankStride?

We're the digital banking solution you've been waiting for.

We make it easy to automate your loan reporting and covenant monitoring. No more managing checklists, searching for files in emails, or waiting on updates from other parties. Just create your requests and let BankStride do the work for you.

How it works

BankStride combines checklists with cloud storage to help you communicate and monitor your information requests and documents.

All it takes to get started:

-

Request items by creating projects for one-off items or templated lists.

-

Review incoming files from your client and mark items as satisfied or complete.

-

Repeat with automatically recurring requests and reminders.

Bankstride platform features

Why do banks and customers love BankStride?